Kinexus has published our 2022 Hiring Intentions and Workforce Report. You can download the full report here.

Among many of the key takeaways the document offers, perhaps the most important is that the defence industry workforce is continuing to grow.

But what is the rate of this growth? Where will the growth happen? And how can defence organisations navigate the tight candidate market to hit their hiring targets? Find out below.

What is the rate of growth?

Kinexus market research and analysis indicates that Australian defence industry expects to grow by around 8.8% in 2022. In a workforce of around 42,000 people, 3,700 new positions will be created this year.

For the first time since 2018, the number of new hires has dropped below the number of the previous year; in 2021 defence industry expected to create approximately 3,810 new positions.

Most defence industry employers are experiencing an attrition rate of between 10% and 15%, and employers should prepare for hiring associated with both workforce growth and replacements of existing workers.

Where will the growth happen?

Workforce growth is being driven by SMEs, consultancies and industry primes alike. Much of the demand is for permanent workers, although shrewd employers are more and more frequently considering contracted workers to meet surge requirements.

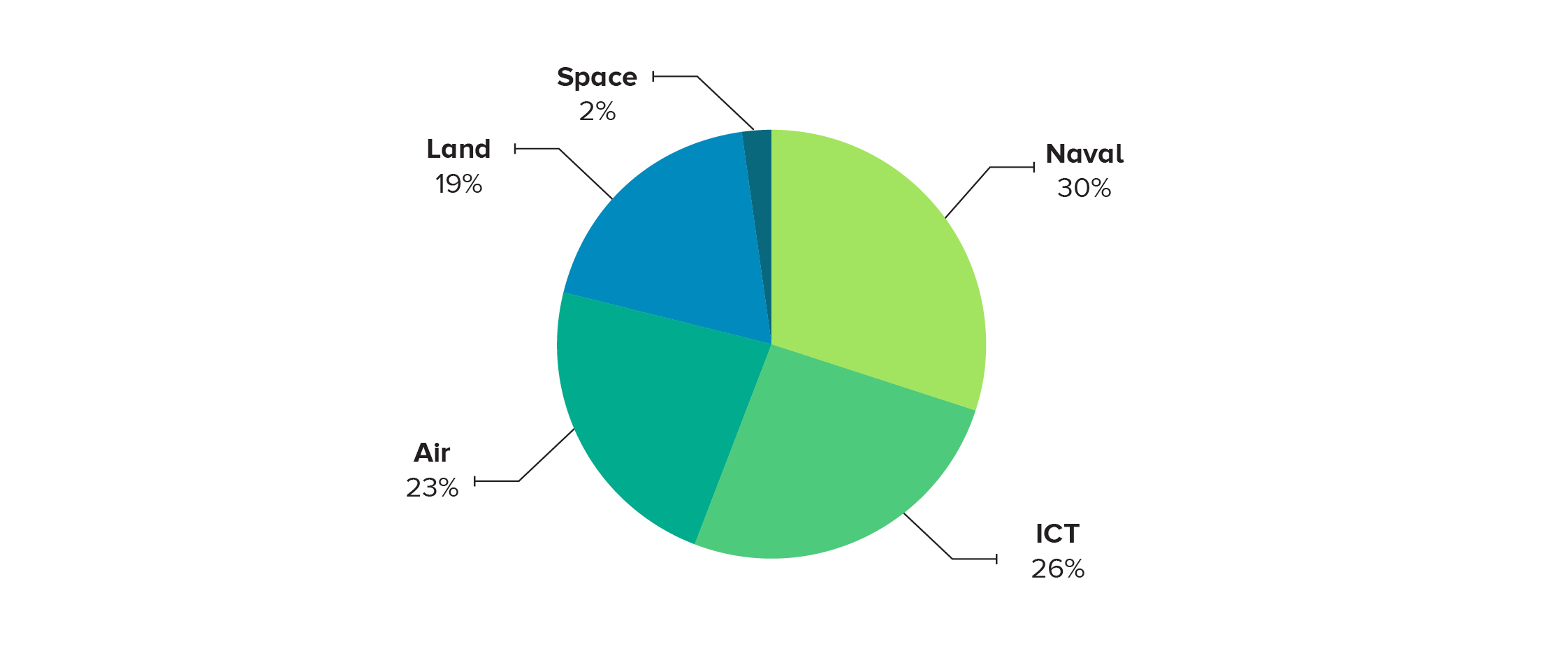

The most significant growth comes from the naval sector (30%) and ICT sector (26%). For the first time we have reported on the space sector in this report, which makes up 2% of all defence industry demand.

Figure 1: Distribution of expected hiring activity by sector

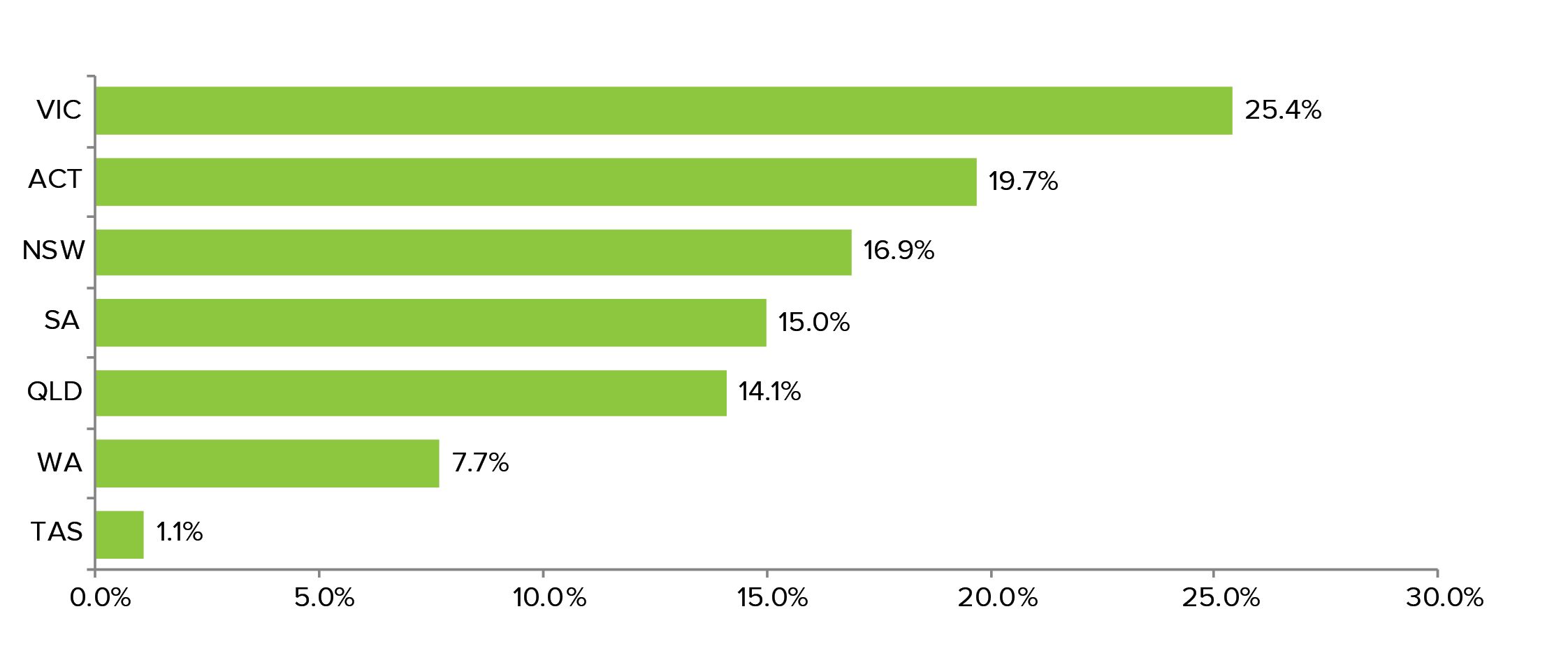

The state of VIC will account for over a quarter of all hires, with ACT making up around 20%. There’s a significant drop in demand from SA, a direct impact of the AUKUS announcement.

Figure 2: Distribution of expected hiring by state

How can defence organisations ensure they hit their hiring targets?

The dearth of available workers with Defence and defence industry experience has led industry employers to sharpen their focus on Employee Value Proposition (EVP) and consider innovative approaches to source workers.

These approaches include efficient utilisation of existing defence industry workers, attracting and integrating workers from adjacent industries, STEM engagement, creating pathways for school leavers and the upskilling of veterans.

Utilising adjacent industry workers

In the Hiring Intentions and Workforce Report we analyse five key skill sets both by location and employing industry, with interesting results.

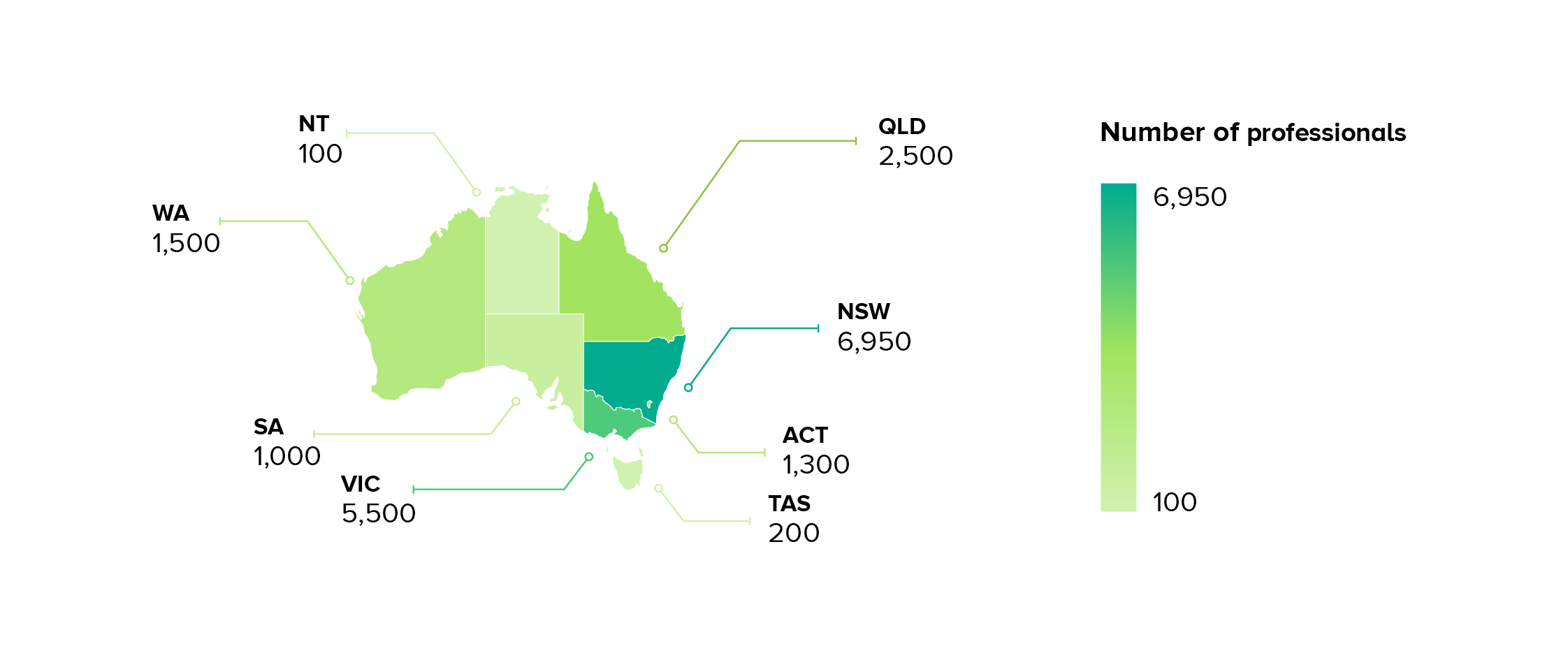

For cyber professionals and software engineers, we found that the vast majority of workers are based in VIC or NSW. This is significant as the ACT has traditionally been the centre of ICT work in Australia. Increasingly, employers that would traditionally locate workforces in Canberra are looking to the VIC market to provide access to the workers they need.

Figure 3: Distribution of professionals with cyber skills by state

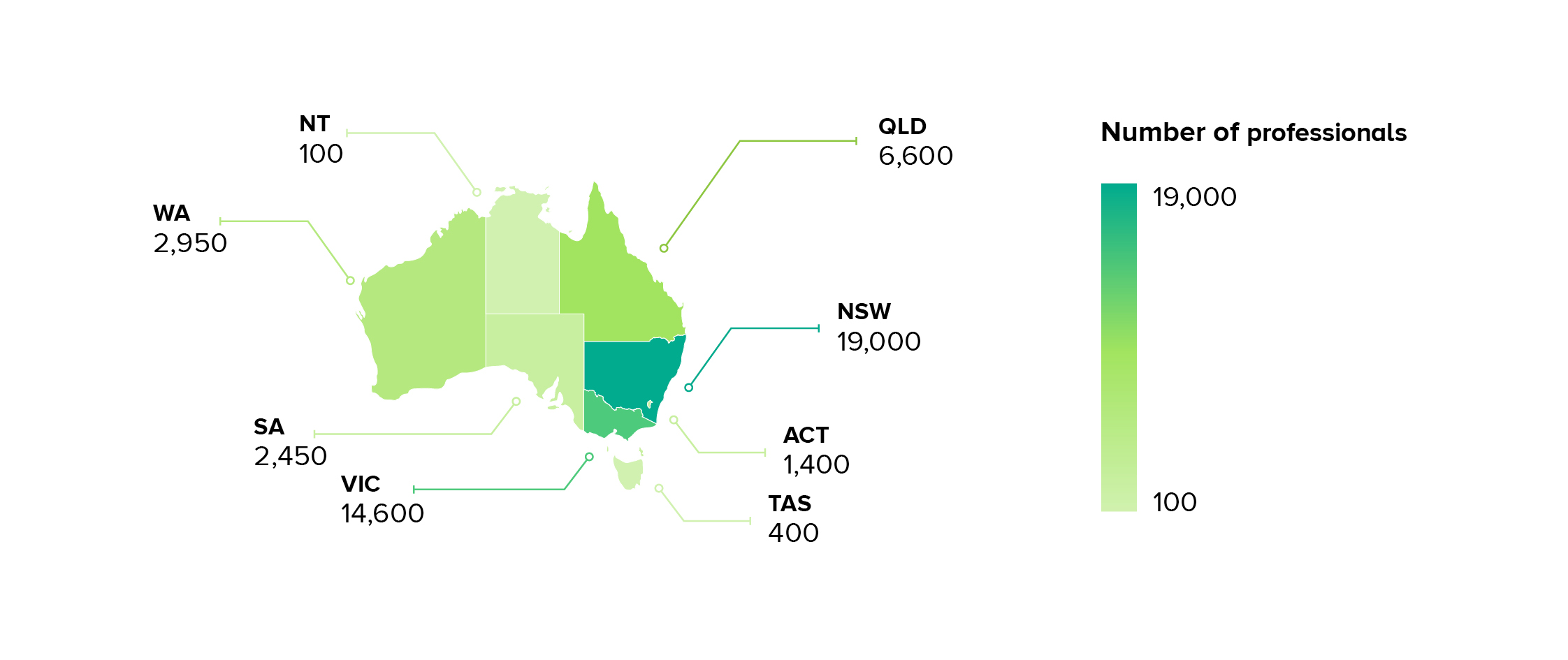

Figure 4: Distribution of software engineering skills by state

Our research showed that many ILS professionals are already employed in defence industry, although many can be found working in the military (ADF). The skills and experience gained in the military provide excellent preparation for ILS roles in defence industry, and employers should capitalise on these well-skilled workers when they choose to discharge.

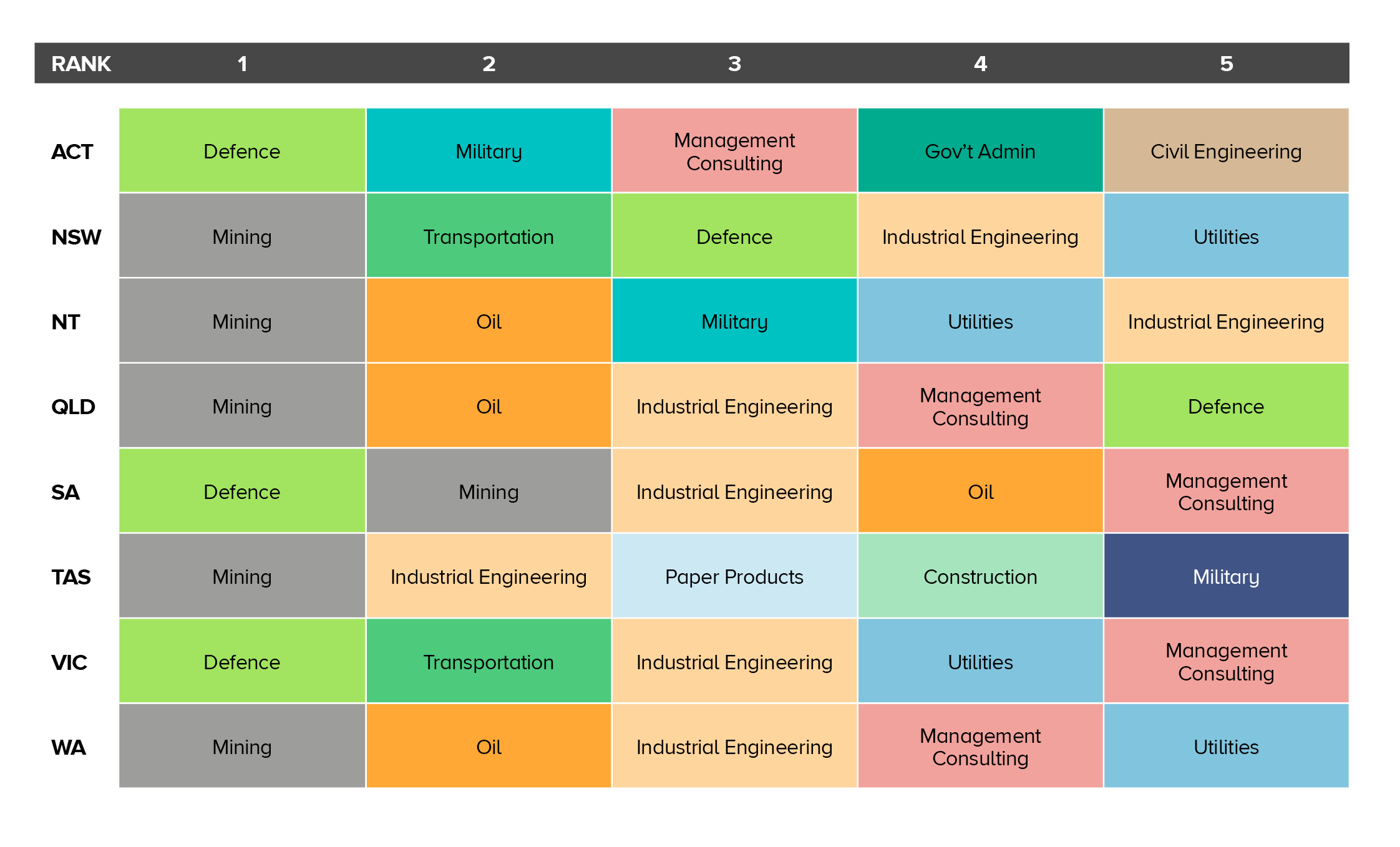

Table 1: Top five industries for employment of ILS professionals by state

Table 1 shows the top five industries employing systems engineers dissected by state. Rank one is the industry that employs the most systems engineers, two is the industry that employs the second most, and so on.

Project and program management professionals are by far the most populous skill set, many of which can be found working in the construction or government administration industries.

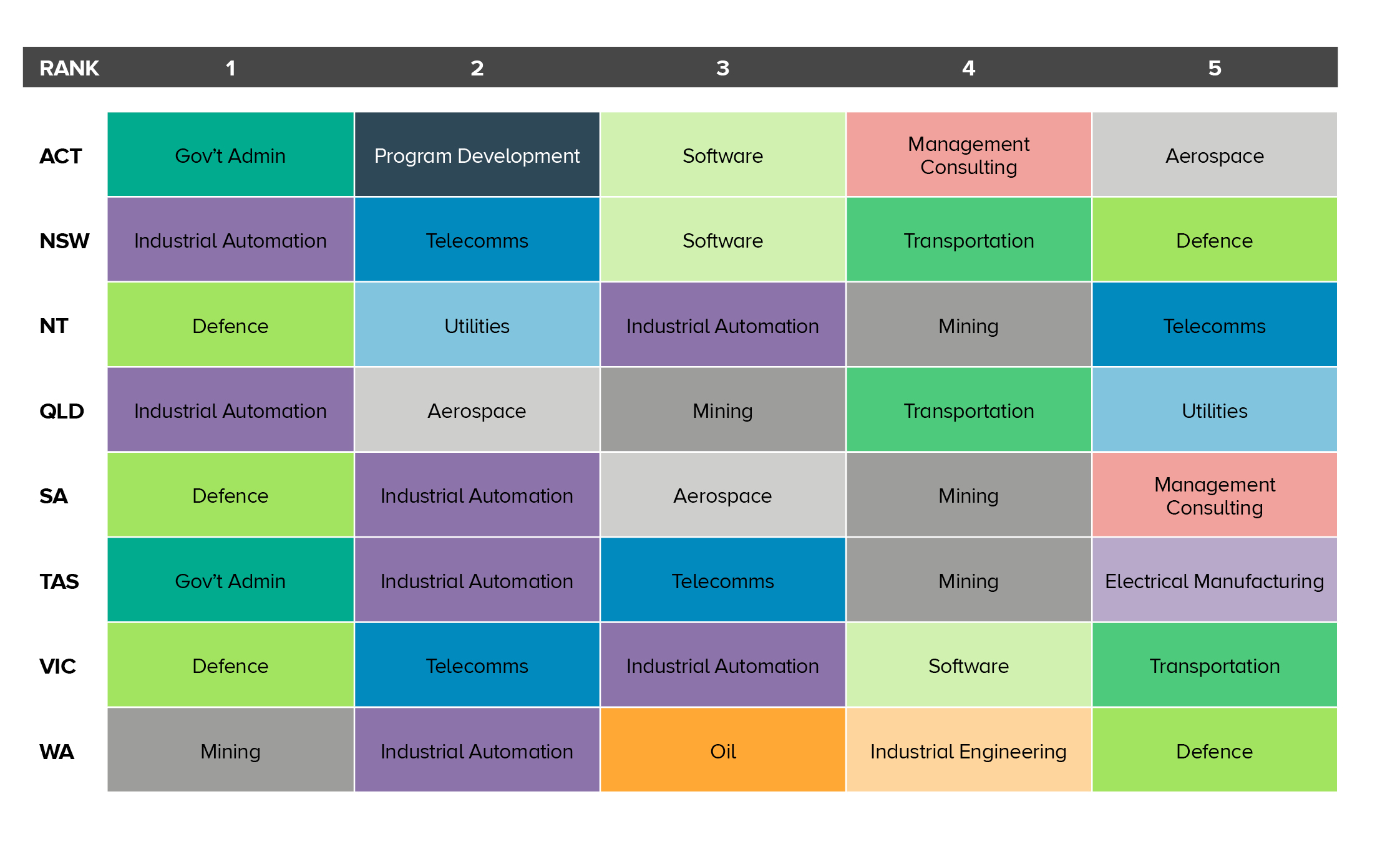

Systems engineers on the other hand number just 6,880 nationally and considering how critical the skill of systems engineering is in the defence sector, careful consideration should be given to the growth of available workers in key locations. Kinexus research shows that systems engineers can be found working in the mining, telecommunications and industrial automation industries, among others.

Table 2: Top five industries for employment of systems engineers by state

Table 2 shows the top five industries employing systems engineers dissected by state. Rank one is the industry that employs the most systems engineers, two is the industry that employs the second most, and so on.

For more information

Kinexus has been conducting workforce research and analysis or the defence industry since 2005 and is recognised as a leading source of defence industry workforce insights in Australia.

For more information you can download the full 2022 Hiring Intentions and Workforce Report here.

To discuss what these insights mean for your workforce strategy contact Kinexus on 02 9492 7500 or by email.